4 min read. September, 29, 2021 – by David Clausen

Although several new private market flood insurers have entered the market in recent years, FEMA’s National Flood Insurance Program (NFIP) still serves as the base policy for most homes insured for flooding. The program currently insures 3.4 million homes throughout the U.S.

For decades, flood insurance was considered too big a risk for most insurers, leaving homeowners with few options. With nearly 75% of declared disasters in the U.S. involve flooding and most flood-related risks not covered by standard homeowner or business insurance policies, the market gap left millions of property owners without viable coverage options. The NFIP was created in 1968 to address this market gap and offer universal access to flood coverage for U.S. homeowners and businesses.

FEMA’s rating system for pricing policies prior to October 1, 2021, used older risk rating methods focused on 100-year flood maps coupled with building elevation. With Risk Rating 2.0, the NFIP has expanded its data to include third-party sources, added new rating criteria, and leveraged technology to bring a more equitable way of pricing policies that considers property risks individually.

In short, as a result of Risk Rating 2.0, NFIP rates will go up for some property owners, but down for others. This change aims to price flood risk more accurately based on modern rating methodology and a better understanding of per-property loss risk.

The NFIP plans to phase the program in over time. New policies started after October 1, 2021 will use Risk Rating 2.0, whereas policy renewals prior to April 1, 2022 will have the option to use the older rating scale or the new Risk Rating 2.0 method.

Why is FEMA making this change with Risk Rating 2.0?

We all remember the devastation of superstorms like Katrina, which famously flooded New Orleans, and Sandy which caused devastation in New York City, New Jersey, and a wide surrounding area. Both storms caused FEMA’s NFIP to take emergency loans from the U.S. Treasury.

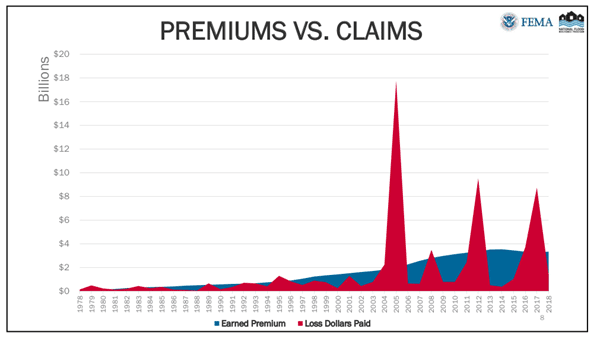

Collected premiums from typical storms paid for damages from smaller storms or flooding events, but NFIP’s legacy rating structure didn’t provide enough reserves to cover losses from larger storms. In the past 50 years, the NFIP has collected $60 billion in premiums while paying $96 billion for claims and operating costs.

Currently, the NFIP is over $20 billion in debt and has just over 5 million active policies, including home and business policyholders. The premium shortfall per policyholder for debt incurred by FEMA reaches $4,000.

With the existing rating system proving insufficient for larger losses, a change to Risk Rating 2.0 allows the NFIP to restructure premiums to better reflect actual risk and remain a viable resource for homeowners nationwide.

Part of the challenge prior to Risk Rating 2.0 was that the premiums used to fund claim reserves increased slowly, but claim losses came in rapidly following a widespread flood event, spiking claim expenses.

The highest point on the claim payouts illustrated below represents claims related to Hurricane Katrina in 2005, followed by Sandy. Notice that premiums also increased following Katrina and continued to rise following Sandy.

The legacy rating system used prior to Risk Rating 2.0 resulted in some policyholders with lesser flood risk or lower home values paying more for coverage than warranted by the risk. In effect, some policyholders subsidized others with more risk or higher home values. However, total premiums collected still didn’t provide enough reserves for larger losses, forcing the NFIP to borrow from the Treasury to cover claims.

Risk Rating 2.0 aims to solve these concerns while maintaining a stable and financially responsible National Flood Insurance Program that can support policyholders for years to come.

Currently, the NFIP has over $16 billion in reserves to pay future claims for policyholders in thousands of communities nationwide.

What does Risk Rating 2.0 mean to existing NFIP policyholders?

If you already have an NFIP policy, you may not see any immediate impact from the new rating system. The NFIP will roll this change out over time according to a fixed schedule. When the changes do go into effect for all policyholders, some property owners will see lower rates, while others will see rates increase based on flood risk.

- Renewals on or after 10/1/2021: NFIP policyholders renewing their coverage on or after 10/1/2021 will have the option of using the old rating system or the new Risk Rating 2.0 system. This move offers an immediate opportunity to save if the new rating system offers lower rates for your property. For other households, the phased approach provides time to budget for the new rates or choose an alternative provider. The NFIP refers to this date period as Phase I.

- Renewals on or after 4/1/2022: In what the NFIP calls Phase II, renewals and new policies written on or after 4/1/2022 will use the new Risk Rating 2.0 methodology to set premiums more closely matched to loss risk.

For most policyholders, the change represents lower rates or largely stable rates. According to NFIP estimates, 96% of policyholders will see a decrease or an increase of less than $20 per month. The remaining 4% of policyholders will see an increase of more than $20 per month.

89% of policyholders will see a decrease or an increase of up to $10 monthly, according to FEMA projections.

New policies written on or after 10/1/2021 are part of Phase I and will use Risk Rating 2.0 immediately.

The NFIP also breaks down the effect on policyholder groups further:

- 23% of policyholders will see an immediate decrease in premiums using Risk Rating 2.0, with an average savings of $86 per month.

- 66% of current policyholders will see a nominal increase or no change in premiums at all. Increases in this group will be less than $10 per month, with some policyholders seeing no change in premiums.

- 7% of policyholders will see a small increase ranging from $10 to 20 per month.

- 4% of policyholders will see an increase of more than $20 per month.

| Projected monthly rate change | Number of policies affected |

| Decrease ($86 average savings) | 1,161,539 (23% of policyholders) |

| Increase less than $10 | 3,323,350 (66% of policyholders) |

| Increase of $10 to $20 | 330,516 (7% of policyholders) |

| Increase more than $20 | 192,836 (4% of policyholders) |

While FEMA offers its premium cost projections monthly, NFIP flood policies are paid annually. For homes with a mortgage, flood insurance is often part of escrow payments made by your lender.

Many existing NFIP policyholders have come to expect to annual rate increases. In part, these increases were due to outdated rating methods that didn’t match risk to premiums as well as the new rating method does. Risk Rating 2.0 aims to break the cycle of perpetual premium increases by more closely matching premiums to loss risk.

If your home is among the policies that will see an increase after Risk Rating 2.0 is implemented, existing affordability guidelines set by Congress still apply.

By law, NFIP premiums cannot increase more than 18% per year for primary homes. Premiums for secondary homes cannot increase more than 25% per year. The higher 25% cap on increases also applies to business properties, non-residential properties, substantially improved properties, and properties with severe repetitive losses.

If your policy cost will increase with Risk Rating 2.0, the limits set by Congress ensure a gradual increase until the policy reaches its full risk rate. However, the projected premium increase for many homes will fall below both the 18% and 25% increase caps.

Risk Rating 2.0 also reduces the maximum premiums for homeowners. Under the legacy rating method, the maximum policy cost was $45,925 annually. Under Risk Rating 2.0, the maximum policy cost drops to $12,125 each year.

Risk Rating 2.0 pricing effect varies by state

While savings under Risk Rating 2.0 are significant for 23% or existing policyholders, bringing an average savings of $86 per month, 77% of policyholders nationwide will pay more for coverage.

The effect of Risk Rating 2.0 also varies by state. Although the rating formula does not take the state in which the property is located into consideration directly, states with higher flood risk may see a greater impact due to Risk Rating 2.0. However, some areas within a state may have less risk than others.

Nationwide, FEMA’s average claim payout for flood damage averaged $69,000 over the past 5 years, more than 5 times the average property damage loss for homeowners insurance policies ($13,424). But some states have lower average flood claim payout rates than others, with covered losses ranging from under $15,000 to nearly $80,000 in the states detailed below.

Here are FEMA’s projections for several states insured by the program:

| State | % Policies with Immediate decrease | % Policies Less than $10 per month increase | % Policies $10 to $20 per month increase | % Policies More than $20 per month increase | Average NFIP claim payout (last 10 years) |

| New York | 32% (54,017 Policies) | 54% (93697 Policies) | 7% (12,042 Policies) | 7% (11,354 Policies) | $55,300 |

| Louisiana | 20% (101,174 Policies) | 70% (343,246 Policies) | 7% (34,352 Policies) | 3% (17,159 Policies) | $56,400 |

| New Jersey | 21% (46,319 Policies) | 64% (137,075 Policies) | 10% (22,426 Policies) | 5% (11,364 Policies) | $47,700 |

| Texas | 14% (106,729 Policies) | 79% (607,645 Policies) | 4% (32,660 Policies) | 3% (21,525 Policies) | $78,700 |

| Florida | 20% (342,142 Policies) | 68% (1,178,074 Policies) | 8% (134,572 Policies) | 4% (73,113 Policies) | $28,100 |

| Maryland | 61% (39,905 Policies) | 36% (23,060 Policies) | 2% (1,355 Policies) | 1% (624 Policies) | $14,900 |

| Virginia | 45% (46,812 Policies) | 48% (50,931 Policies) | 5% (5,093 Policies) | 2% (1,949 Policies) | $16,800 |

| California | 27% (57,549 Policies) | 63% (135,640 Policies) | 6% (13,560 Policies) | 4% (8,116 Policies) | $20,100 |

Side-by-side state comparisons can be useful to understand statewide trends in pricing. For example, Texas has the highest average claim value in the table above. Texas also has the lowest percentage of policies that will see decreases in premiums. However, inland or elevated areas of a state may have less flood risk than coastal areas, so coverage costs can vary widely within a state.

Which rating factors affect rates under Risk Rating 2.0?

The NFIP’s Risk Rating 2.0 uses data sourced from government agencies as well as third-party commercial sources to build a more comprehensive risk-modeling framework.

Rating variables that can affect premiums for property owners include:

- FEMA-sourced map data

- Distance from the coast or other water sources

- Stream order, which refers to the relative size of nearby rivers or streams

- Flood risk type (Fluvial/Pluvial): River flooding (Fluvial) versus surface flooding (Pluvial)

- Ground elevation of insured structure

- First floor height

- Construction type and foundation type (wood/metal frame/masonry/other)

- Cost to rebuild including foundation

- Building occupancy (single-family, manufactured home, condo, etc.)

- How often the area floods

- Prior claims for claims made after Risk Rating 2.0 launch

Risk Rating 2.0 uses a wider range of rating factors compared to FEMA’s legacy rating method, providing a better reflection of per-property risk. Combined with data from a broader range of sources, Risk Rating 2.0 offers a more accurate snapshot of each property’s flood risk.

This new rating methodology marks a departure from the NFIP’s previous heavy reliance on flood maps and assigned flood zones to set premiums. Flood map data still plays a role in risk rating, however, and will still be used to determine flood insurance mortgage requirements for federally backed mortgages.

How will Risk Rating 2.0 affect new policyholders?

New NFIP policies written on or after 10/1/2021 will use the new Risk Rating methodology.

New policies require a 30-day waiting period before the policy becomes effective, with a few exceptions provided. New policies purchased to meet lender requirements are not subject to the waiting period requirement, however. Changes to existing policies are also not subject to waiting periods.

After your new policy is in place, Risk Rating 2.0 aims to provide more stable pricing based on loss risk for each property.

Grandfathering rules for Risk Rating 2.0

Risk Rating 2.0 brings big changes to the way the NFIP sets premiums, but many features remain as part of the National Flood Insurance Program.

- Discounts for pre-FIRM subsidized and newly mapped properties are still available. Pre-FIRM properties are buildings built on or before 12/31/1974 or before the effective date of an initial Flood Insurance Rate Map (FIRM).

- Discounts can pass to new property buyers. If you sell your home, discounts for pre-FIRM properties can be passed to the new owners.

- Community Rating System (CRS) discounts still apply. Nationwide thousands of communities qualify for additional discounts based on community-level steps taken to reduce flood risk to insured properties. Discounts range from 5% to 45% and will continue for policies that use the new Risk Rating 2.0 system. FEMA has provided a list of eligible CRS communities and the percentage discount for each as of 10/1/2021.

- Available coverage limits for homes and businesses remain unchanged.

Repetitive loss property impacts

Of the more than 5 million properties insured with NFIP policies, just over 12 thousand properties are located in high-risk coastal zones. Weather and flood events can be unpredictable, though, bringing flood losses in areas you might not expect.

Properties with multiple losses for current or prior owners may be deemed as repetitive loss (RL) or severe repetitive loss (SRL) properties. Existing policies with this designation have been paying a surcharge that has increased over the years.

By FEMA estimates, SRL properties make up 1% of NFIP-insured properties but represent nearly 40% of paid claims.

- FEMA defines a Repetitive Loss (RL) property as one that has 2 or more claims with the NFIP of $1,000 or more over a 10-year period.

- FEMA defines a Severe Repetitive Loss (SRL) property as one that has 4 losses of $5,000 or more or 2 claims that exceed the value of the property. At least 2 of the claims must be within 10 years of each other.

Risk Rating 2.0 gives most policyholders a clean slate in regard to claim history for their property, but FEMA will still charge a SRL surcharge for properties designated as SRL. However, if you have a new claim for a SRL property after converting to Risk Rating 2.0, the SRL surcharge is replaced by a new rating element that considers prior losses instead.

In this case, Risk Rating 2.0 will use 20-year rolling claims history to calculate the prior claim rating element with one claim removed from the formula. For example, if you have 2 claims prior to Risk Rating 2.0 and then have another claim following your conversion to the new rating method, FEMA will use 2 of those 3 claims, assuming they all happened within the previous 20 year rolling period. If a claim happened more than 20 years ago, it is not used as a rating factor.

Unlike private insurers, the NFIP cannot refuse to insure a risk. However, properties with higher risk or a severe loss history may pay more for coverage compared to other properties under the new rating method.

If your property is at higher risk, discuss your coverage options with your agent. Several private market insurers now offer coverage options that may be priced more affordably or offer more flexible policy options.

How to benefit from the NFIP’s Risk Rating 2.0 plan

NFIP Risk Rating 2.0 brings a much-needed change that helps ensure a stronger program for all policyholders. The new rating methodology uses a broader data set and more variables to assess risk more accurately. For most policyholders, this means rates will go down or see a manageable increase with better long-term stability in rates.

Take advantage of the phase-in period for high-risk properties

In some cases, rates may increase under Risk Rating 2.0 compared the NFIP’s legacy rating method, particularly for higher-risk properties. However, rules set by Congress limit how much rates can go up each year, allowing property owners time to consider coverage strategies.

Existing policyholders can renew their coverage using either the old or new rating system, with Phase II (full conversion) not effective until April or 2022. This phase-in structure provides time for property owners to plan before the new rates apply.

Consider converting early if your premiums will decrease

There’s no requirement for renewing policies to change to Risk Rating 2.0 immediately. For renewals prior to 4/1/2022, agents will calculate your rates under both rating systems, giving you access to whichever rating system offers the lowest coverage cost.

For many homeowners, it may make sense to convert to the new risk rating system at the first opportunity. The rollout of Risk Rating 2.0 allows those who will benefit from the new rating system to convert as soon as their policy is up for renewal. However, Risk Rating 2.0 cannot be applied before renewal.

If the new rating system will be favorable to you, it may make sense to convert before the Phase II deadline in April of 2022.

Consider other flood insurance options

Recent changes allow NFIP policyholders to change providers more easily than in the past, but often the best juncture to make a change may be when your current policy term is expiring.

In years past, few private market insurers offered flood coverage, However, with better technology tools to understand risk, many new private market insurers have now entered the flood insurance space.

With more options available for many property owners, there may be advantages in policy options or pricing by choosing a private market policy. In many cases, private market flood insurance policies can act as a drop-in replacement for an NFIP flood insurance policy and enjoy wide acceptance with many mortgage lenders.

In some situations, it may also be prudent to consider additional coverage. While Risk Rating 2.0 promises a more equitable approach to flood insurance pricing, it does not expand the coverage limits available for homes and businesses. For example, building coverage is still limited to $250,000 for homes and $500,000 for businesses. Similarly, building contents coverage is capped at $100,000 for homes, creating a potential coverage gap for many property owners.

Several leading private market insurers offer excess flood insurance that can expand the coverage limits for your home or business by acting as secondary insurance. Some private market providers also offer higher limits for a base policy, possibly removing the need for a secondary policy.

Discuss your flood coverage options with your trusted agent

Risk Rating 2.0 will affect property owners in different ways. For some, the new rating system may bring savings, whereas for others, there may be increases in the cost of coverage. Risk Rating 2.0 also considers more property-level factors, which means your rates may differ from your neighbors’ rates.

Policyholders benefit from a phase-in period that prevents immediate increases for existing policies. The phase-in period also allows time to discuss your coverage needs with your agent. Insurance needs often change over time. A periodic policy review helps ensure that your insurance policies protect against your currents risks and helps prevent gaps in coverage that can occur as life changes.

Reach out to your agent to schedule a policy review.

Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.

About the Author

David W. Clausen is the CEO of Coastal Insurance Solutions. With over 20 years' experience and over 1 billion insured, David and Coastal Insurance Solutions are the recognized leaders in high net worth insurance. For the fifth consecutive year, David Clausen has been awarded Top Producer by Insurance Business America. David is a trusted high net worth insurance expert who’s published more than 200 articles. His articles & press releases have generated over 500K pageviews and has been featured on blogs such as Google News, Yahoo Finance, CNBC, Market Watch, Fox, The New York Times, etc. David founded Coastal Insurance Solutions in 2001 after earning a BBA from the State University of New York College at Oswego.

![IBA Top Retail Brokers 2024 Medal[88] IBA's Top Retail Broker 2023](https://coastalinsurancesolution.com/wp-content/uploads/2024/07/IBA-Top-Retail-Brokers-2024-Medal88.png)

![IBA Top Retail Brokers 2024 Medal[88] IBA's Top Retail Broker 2023](https://coastalinsurancesolution.com/wp-content/uploads/2024/07/IBA-Top-Retail-Brokers-2024-Medal88.png)